refinance closing costs transfer taxes

New York 2000. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

Many counties in Minnesota require a Conservation Fee payment.

. Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size. How refinance closing costs are determined. Transfer Tax 5 No County 5 State Property Tax 118 per hundred assessed value 1048 County 132 State CECIL COUNTY 410-996-5385 Recordation Tax 820 per thousand.

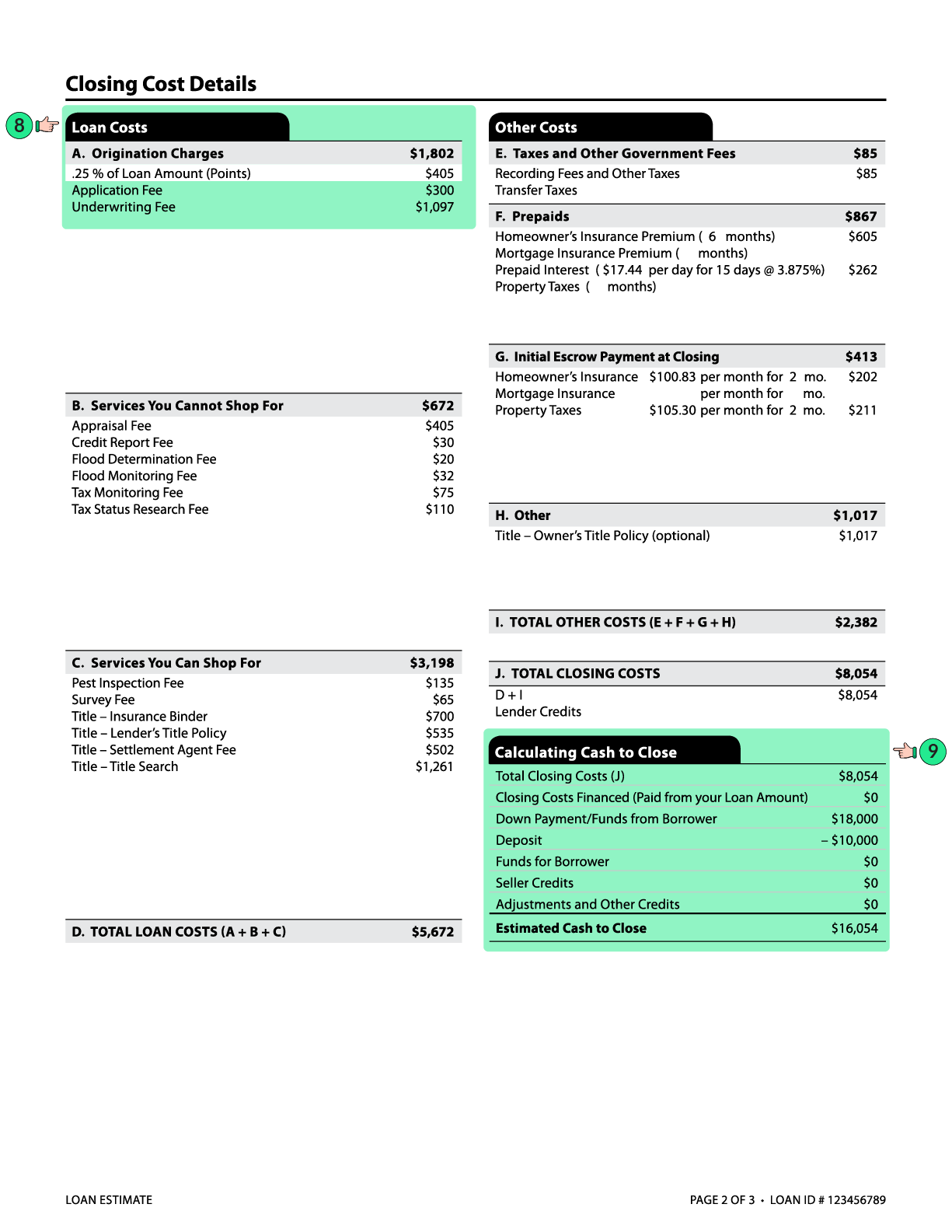

Average closing costs in New York. Purchasing A Home In Florida Florida Refinance. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Because each persons tax. 70 cents per 100 Documentary Stamps State Tax on the Deed. Closing costs typically range between 2 and 6 of your loan amount.

This rate may be different for each Minnesota county or Wisconsin. Mortgage closing costs typically range between 2 and 6 of your loan amount. In fact the average buyer will pay between 2-5 of their loan amount in closing.

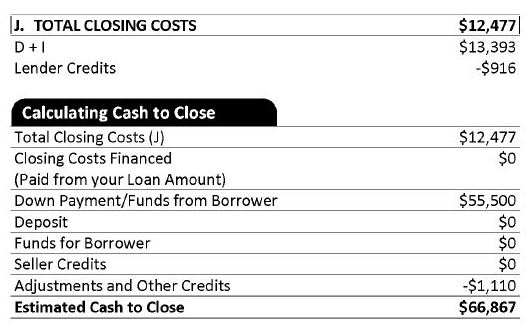

Closing cost credits are often necessary to help cash-starved borrowers close transactions as total closing costs can easily exceed 10000 for even inexpensive homes. Trust Tax 333 per thousand of the loan amount s Grantors Tax 100 per thousand typically paid by seller. 52 rows Total transfer tax.

If youre refinancing a. How to Pay Closing Costs When Refinancing Your Mortgage. If you do a cash-out.

State Transfer Tax is 05 of transaction amount for all counties. If you buy a home in that price range the average closing. What are closing costs on a refinance.

When youre determining what to claim on your taxes it helps to know IRS rules. Points paid on a cash-out refinance for home improvements. Deed Tax 333 per thousand of the salespurchase price.

Across the state the average home sale price is between 400000 and 500000. Some of the closing costs you can tax deduct on a refinance mortgage in the year you pay them are. State laws usually describe transfer tax as a set.

Average closing costs normally range from 2 to 5 of the loan amount. You can write off some closing costs at tax time. Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and.

2400 12 680 034 None. The tax is calculated per 100 of Price Loan Amount or Mortgage Amount. Note that transfer tax rates are.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower. As you can see closing costs and taxes can cover a wide range of different fees and expenses. Average refinancing closing costs are 5000 according.

When youre determining what to claim on. Transfer taxes are not tax. The amount is 0 when Minnesota County is Other Counties or when the property is located in Wisconsin.

According to Section 201021a Florida Statutes Deeds and other documents that transfer an interest in Florida real property are subject to documentary stamp tax. Sellers can deduct closing costs such as real estate commissions legal fees transfer taxes title policy fees and deed recording fees to lower the profit and lower the.

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

The Cost To Refinance A Mortgage And How To Pay Less

What Are Real Estate Closing Costs And How Much Will You Pay Ap Fredericknewspost Com

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Understanding Closing Costs Sirva Mortgage

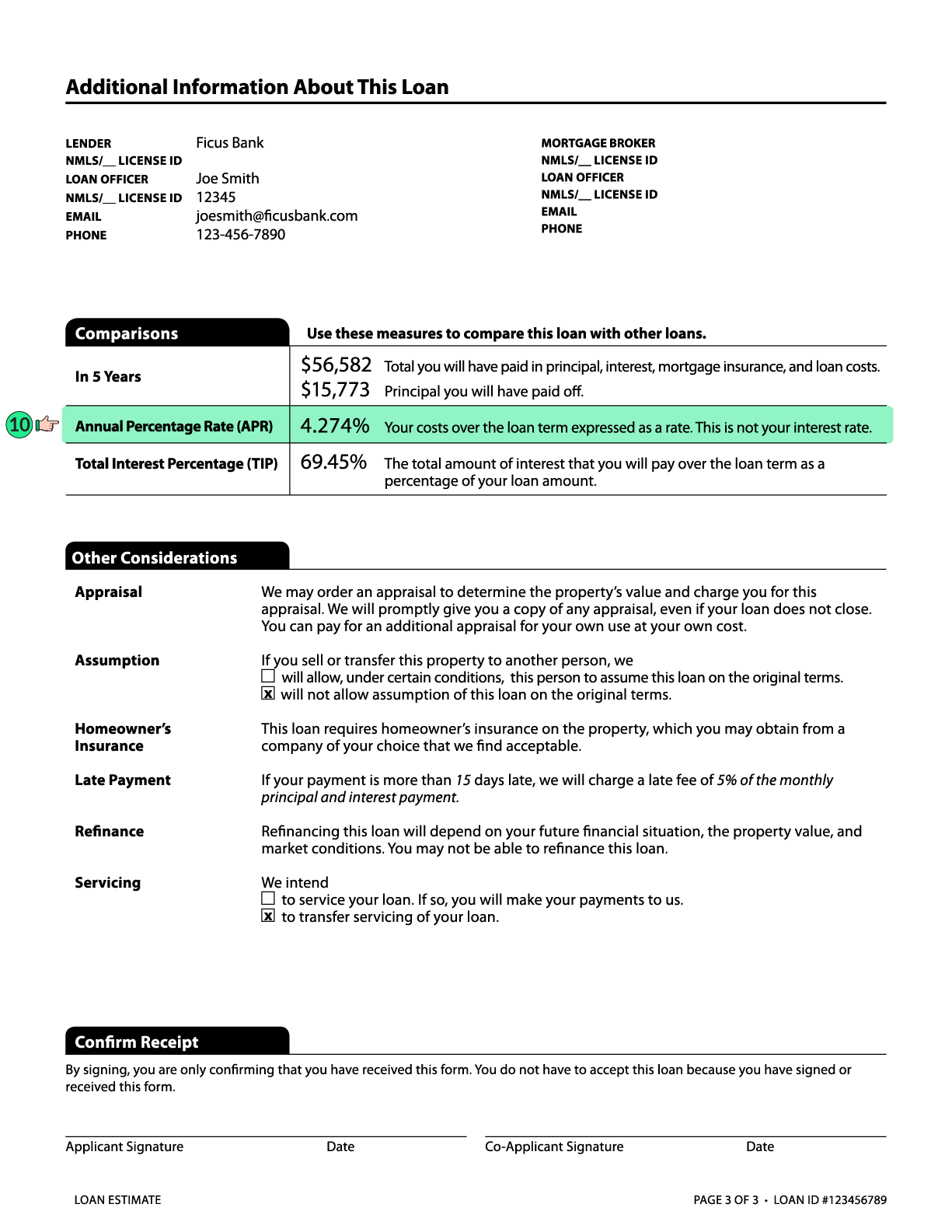

What Is A Loan Estimate How To Read And What To Look For

Closing Costs That Are And Aren T Tax Deductible Lendingtree

The Estimated Settlement Statement Jackson Fuller Real Estate

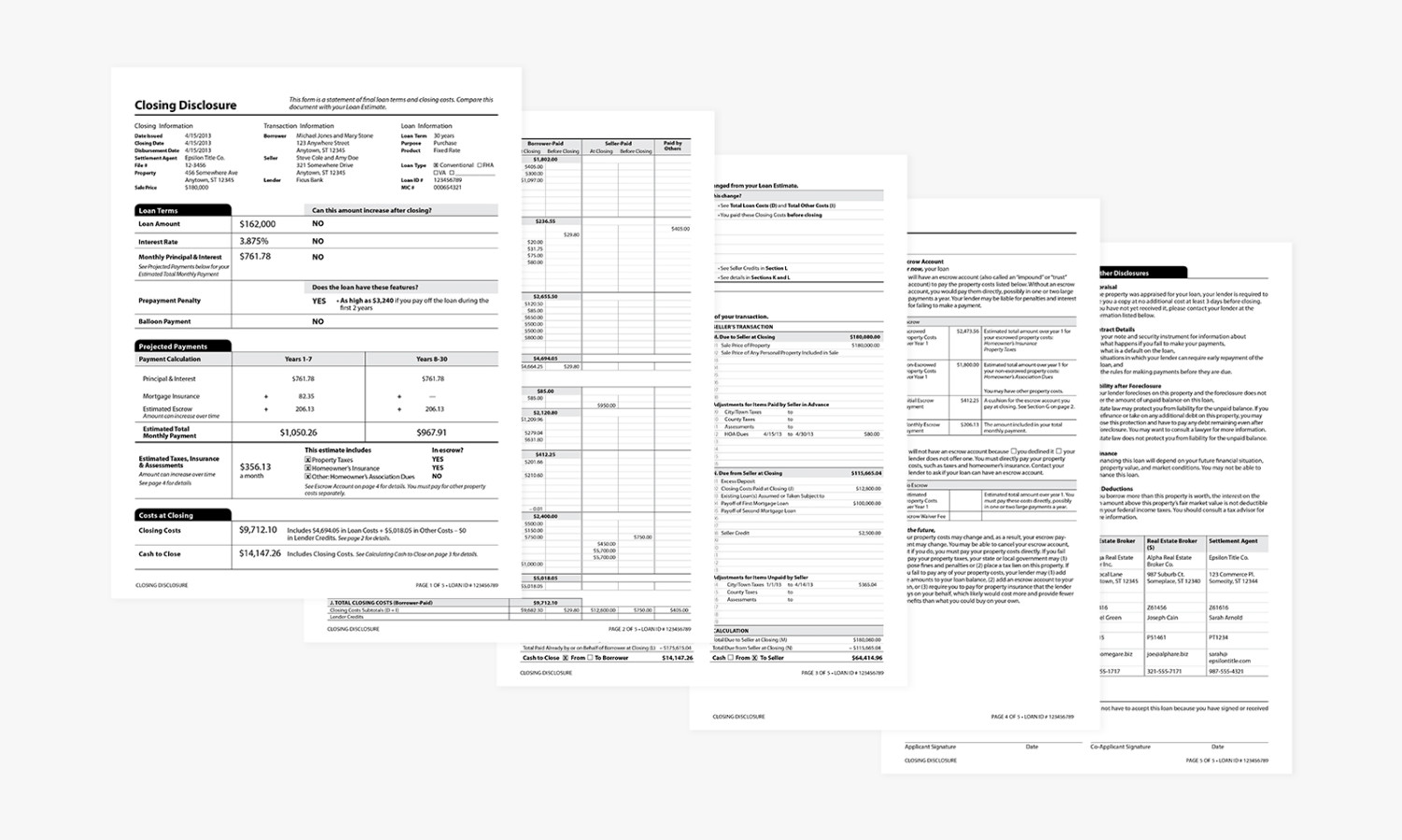

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

How To Calculate Closing Costs On A Nc Home Real Estate

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

What Is A Loan Estimate How To Read And What To Look For

Transfer Tax Alameda County California Who Pays What

Refinancing Your House How A Cema Mortgage Can Help

Average Closing Costs In 2022 Complete List Of Closing Costs

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro